Agevolazioni fiscali purificatori d'aria

Why choose RefineAir

Detrazioni fiscali

É possibile interconnettere l’impianto in modo diretto, con interscambio bidirezionale, ai processi produttivi e\o dei servizi connessi al business. L’impianto rientra nell’Allegato A della legge di bilancio Legge del 11/12/2016 n. 232 e le relative FAQ ed Approfondimenti effettuati dal MEF; Per tali motivi l’impianto è agevolabile secondo le specifiche del Credito d’Imposta in vigore per l’attuale anno fiscale che nel 2023 è pari al 20%. É anche possibile cumulare le agevolazioni fiscali con la misura “Credito del mezzogiorno” per arrivare fino al 65% al Sud e nelle Isole.

All inclusive solution

RefineAir has created an intelligent system at the service of its customers, providing know-how to designers, installers and maintainers throughout the country. From the inspection to the testing and commissioning of the system.

Maintenance remind

To keep your system running efficiently, you should follow these two simple steps:

- Inspect TiO2 filter every 30-40 days for dust. Replace every 6 months.

- UV-C lamp should be replaced every 12 months

You don't have to worry about any of this, RefineAir Management will send an alert to remind you!

Advanced tecnology

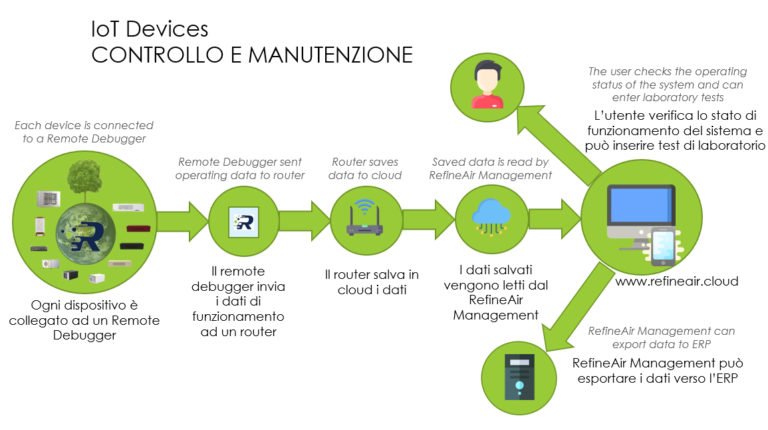

We have combined the best IoT technology with our active air purification systems, allowing real-time verification of the operating status of the entire system through the use of the RefineAir Management platform. This tool is capable of exporting data to the ERP and uploading microbiology tests to the network.

FLEXIBLE SYSTEM

Quick and easy installation, with the ability to use stand-alone and/or in-duct devices.

CONTINUOUS ACTIVE PURIFICATION IN THE ENVIRONMENT AND ON SURFACES

Active purification systems protect you H24 from viruses, bacteria, mold, VOCs and other pathogens, without being harmful to humans.